Fintech Global Expansion Analyst

Unlocking Your Fintech Potential with Expert Growth Consulting

At The Change Hive, we take pride in being your go-to partner for all your fintech growth needs in the UK. Our team of enthusiastic specialists is dedicated to helping fintech businesses flourish and be successful in this dynamic digital environment. We understand that the fintech industry demands innovative strategies, data-driven insights, and a global mindset to achieve remarkable growth and stay ahead of the competition.

Unlocking Fintech Potential: Expert Growth Analysts at Your Service

Our Growth Analysts possess in-depth expertise in the fintech sector, enabling them to unravel hidden opportunities and challenges specific to your business. With a keen eye for detail, our analysts delve into your data, identifying growth drivers and areas for improvement. Armed with these insights, we collaborate closely with your team to devise strategies that fuel your business’s growth trajectory.

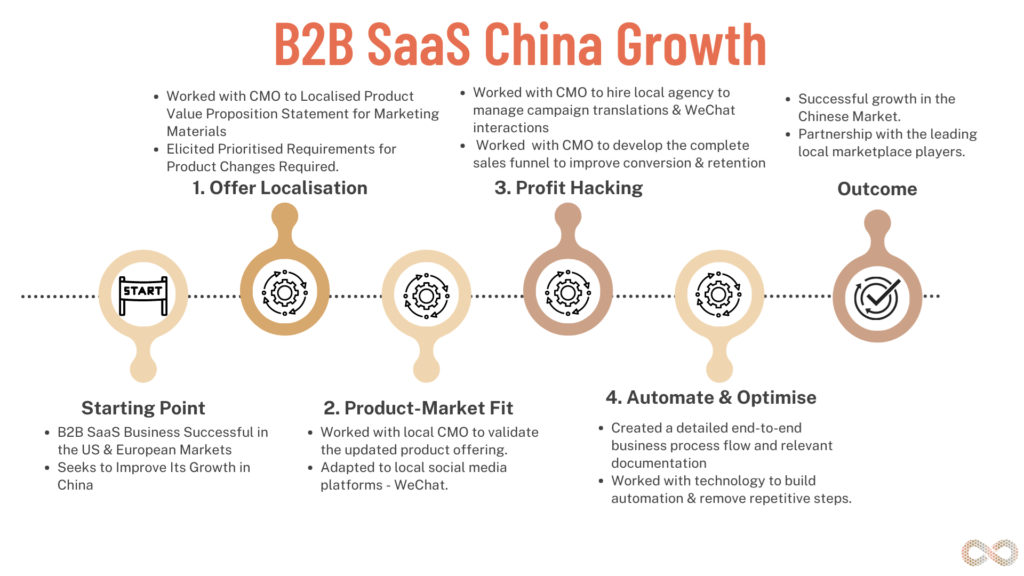

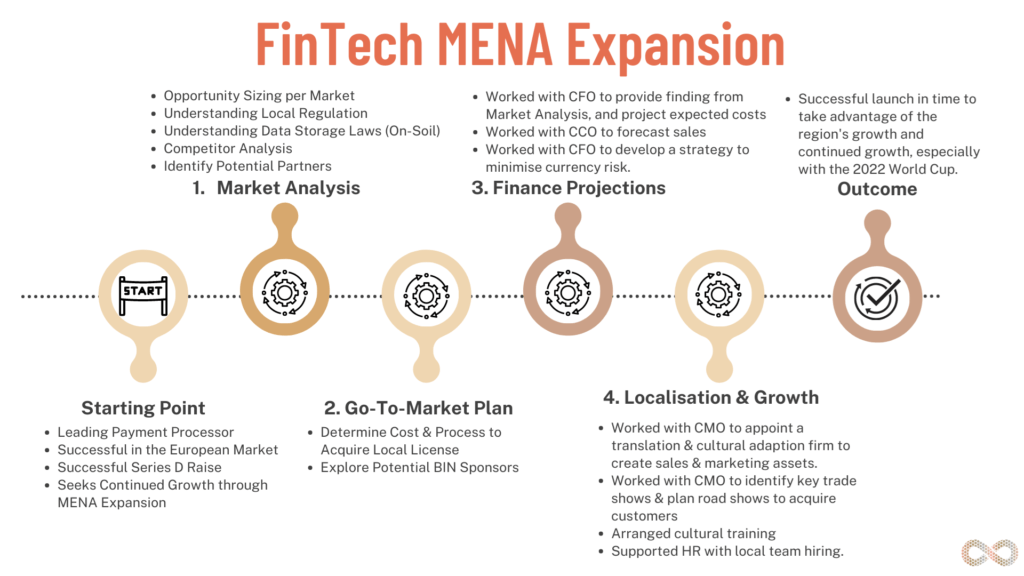

Navigating Global Expansion with Fintech Consultants

As a fintech business with ambitions for international success, our Fintech Global Expansion Consultants are here to guide you every step of the way. We undertake comprehensive market research, assess regulatory landscapes, and study competitor landscapes to chart your course for global expansion. Our strategic approach ensures you penetrate new markets successfully, creating a global footprint for your fintech venture.

Driving Fintech Innovation through Strategic Partnerships

Collaboration is the cornerstone of fintech innovation, and our Fintech Partnerships Analysts are experts at forging strategic alliances. We evaluate potential partners that complement your vision and drive business growth. Whether it’s forming joint ventures, alliances, or partnerships, we ensure that your fintech enterprise gains a competitive edge and unlocks new growth opportunities.

Embrace the Future with FinTech Digital Transformation

In the rapidly advancing fintech landscape, digital transformation is non-negotiable. Our FinTech Digital Transformation experts work closely with your team to identify digital gaps and streamline your operations. We help you integrate cutting-edge technologies, enhance customer experiences, and optimize processes, setting you on the path to digital success.

Experience Growth with The Change Hive

As your dedicated Fintech Growth Consultant UK, we are committed to your success. With our tailored strategies, data-driven insights, and global expertise, we empower your fintech business to thrive in the digital era. Partner with The Change Hive today and embark on a transformative journey toward unparalleled growth and achievement.